Federal & State Tax Return Deadline

April 15, 2026

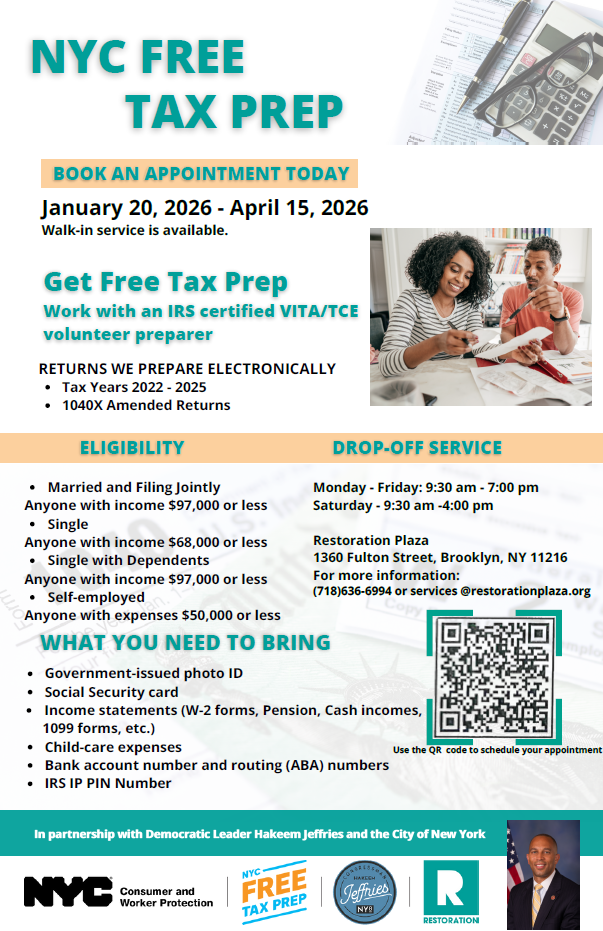

In 2023, 1 in 3 Americans with an annual household income of less than $50,000 paid a tax professional or company to do their taxes even though they likely would have gotten that help for free. Residents of the Eighth Congressional District of New York have several valuable resources to help them during the 2025 tax season.

The NYC Department of Consumer and Worker Protection (DCWP) provides free tax preparation services for families who earned $93,000 or less or singles who earned $65,000 or less in 2025. Please visit NYC Free Tax Prep – ACCESS NYC to learn more about what to include and how to apply, as well as the IRS website for general guidance. You can find more information for small businesses by visiting Small Businesses Self-Employed | Internal Revenue Service.

Services

IRS

Individual Online Account

The IRS Individual Online Account now offers real-time chat support and enhanced financial management tools, including flexible payment scheduling and secure bank account storage. This significantly improves user convenience and security in managing tax obligations.

These upgrades, combined with access to comprehensive tax records and robust security measures, provide a streamlined and secure user experience for managing tax obligations.

IRS

Free File program

The IRS Free File Program offers two free online tax filing options: Guided Tax Software for taxpayers with an Adjusted Gross income of $84,000 or less, and Free File Fillable Forms for those above this threshold.

This public-private partnership ensures accessible, secure tax preparation and filing solutions for all income levels, reducing the cost of tax compliance for millions of Americans.